Our Investment Approach

Have a question about the investment process?

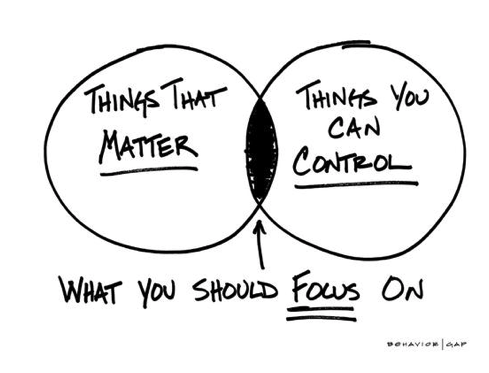

There are many opinions about how money should be managed. Our approach is that we will rely on credible research from unbiased sources is to determine what factors matter in portfolio construction. The challenge is to identify investment strategies that predictably create reliable long-term value relative to your individual needs. During select periods most strategies can create value. Our core investment philosophy is based on 50+ years of academic research as we seek strategic advantages available within a low cost broadly diversified portfolio.¹ The substantial body of academic research strongly suggests that using a low cost, tax efficient asset allocation approach will produce a more reliable, predictable and manageable investment discipline and methodology.²

Long-Term Success Factors

A Process Driven Approach

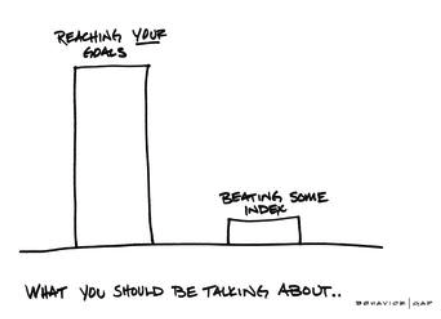

You don’t just invest for the sake of investing. You invest to meet a need or desire, goal or aspiration. We believe to be prudent, investing must be related to your specific objectives. Our recommended portfolios are designed to align with and meet your specific goals. And since no one has control over the results, we focus our attention on the processes that will lead to your success. Our best athletes, leading scientists, creative educators, and successful investors realize that performance is not a goal, performance is a result.

Let Markets Work

The cornerstone concept of modern economics is that a free and competitive market system is the most efficient way to allocate resources. Securities markets throughout the world have a history of rewarding investors for the capital they supply. Companies compete for investment capital, and millions of investors compete with each other to find the most attractive returns.

This competition quickly drives prices to fair value, ensuring that no investor can expect greater returns without taking greater risk. The result is an efficient market system with prices that incorporate all available information as well as future expectations and are the best approximation of fair value.

Classical investment approaches attempt to outsmart the collective wisdom of all market participants by trying to identify pricing “mistakes.” Mountains of academic research illustrates that these approaches are costly and often futile. As these predictions often fail, investors are exposed to the risk of missing out on the strong returns that markets provide. Our investment philosophy allows us to harness the power of capital markets.

Investing vs. Speculating

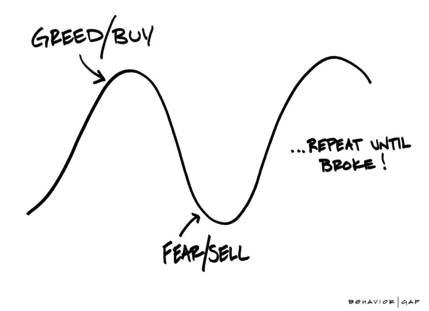

Many investors follow the crowd and make investing decisions based on what they hear in the media. Stock-picking has proven to be inconsistent and too unpredictable to be a reasonable method of beating the market. Financial planners know that this is not what contributes to investing success.

What contributes to your financial success, more than anything else, is your ability to make a plan and stick with it. Now, that's easier said than done when the event du jour causes fear and anxiety. That's why our services have significant benefits. Helping people resist both the impulse to chase hot performing funds and the urge to flee in down markets. We help you tune out the noise of the markets and adhere to a well-consider investment strategy. We don't make bets on the price of gold or the latest tech stock when it comes to your retirement money. Our core portfolios are constructed using low-cost, passive mutual funds and ETF's.

Timing the Market Doesn’t Work

Well-known experts agree, that trying to predict what will happen in the market adds risk, costs and uncertainty with no additional expected return.

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

- Peter Lynch

“I have never known anyone who could consistently time the market. And in fact I’ve never known anyone who knows anyone, who was able to consistently time the market.”

- Princeton Economist Burton Malkiel

Trying to “time the market” is the #1 mistake to avoid: “People that think they can predict the short-term movement of the stock market — or listen to other people who talk about (timing the market) — are making a big mistake”

- Warren Buffett

Structured Asset Class Investing

We offer a disciplined, unemotional, and highly diversified investment approach that offers you objective advice rather than financial products to buy. We call it structured asset class investing. It is based on the science of investing that cuts through the noise and confusion by focusing on what really drives investment returns, helps reduce volatility, and simplifies the investment process. The core concepts of structured asset class investing are not new. They are time-tested and supported by decades of empirical research.

Effective Diversification Plus

Diversification is much more than the idea of not putting all your eggs in one basket. An effectively diversified portfolio is constructed of securities, or preferably entire asset classes, that do not share common risk factors and therefore tend not to move together. It has components that may zig while others zag, creating more consistent, less volatile returns that compounds money at a greater rate than a more volatile portfolio with the same average return.

To accomplish this, managers combine asset classes in a portfolio that have dissimilar return patterns. They invest globally across thousands of securities to minimize single-security risk and to capture the diversification benefits of different country markets and currencies. They also combine equities with, high quality, short-term fixed income securities that have a low correlation with stocks.

Our experience has taught us that many investors benefit not just from the diversification described above, but also from diversification of investment types (individual securities vs. exchange-traded funds (ETFs) vs. mutual funds), diversification of holdings strategies (tactical vs. passive) and diversification of tax characteristics (taxable vs. tax deferred vs. tax-free).

To help enable you to achieve this “effective diversification plus” we offer access to approximately 170 Mutual Fund Advisory portfolios and 90 Separately Managed Account strategies that may be blended together to me your unique needs.

All managers on our platform are put through a rigorous due diligence process. Experienced analysts conduct research, on-site visits, and apply critical thinking to identify managers with an investment edge that is defensible, differentiated, repeatable, and sustainable.

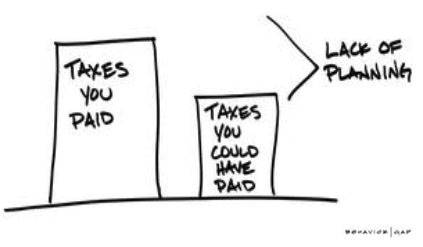

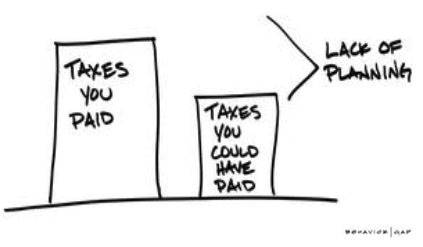

Tax Strategies

Taxes are unavoidable, but paying too much in taxes, can be avoided. At Fimognari Financial, one of our key financial planning strategies is finding ways to reduce the amount you pay in taxes annually. Our proven strategies to reduce taxes are important part of your overall financial plan because unlike the market, taxes are something we have some control over.

The strategies you use to manage your accounts to control long-term and short-term tax liabilities can make a significant difference in the net after-tax value of your investments. We coordinate with your tax professional to implement strategies that can control your tax liabilities and ultimately may enhance the value of your investments. Within our asset management platform, we offer techniques such as tax-loss harvesting to offset capital gains tax on taxable portfolios. We carefully structure your portfolio by locating your assets in appropriate accounts to give you the highest net after-tax value over time. We also help client with Roth conversion strategies to reposition assets from being forever taxed to never taxed. After all is not how much you make but what you keep that counts!

Portfolio Rebalancing

Even the best designed portfolio needs attention. Otherwise, a carefully constructed asset allocation will drift due to varying performances of the portfolio’s investments or managers. That’s why every portfolio is monitored regularly to identify opportunities for rebalancing. Rebalancing is done for you automatically which helps manage risks and your performance. There is no additional fee for this service.